Long Term Care Planning

long term care planning in florida

It is a statistical reality that the majority of Americans who live beyond a certain age will require some type of long-term care services as their lives continue. Long-term care can be extremely expensive depending on the type of services and the length of time they are needed. Deciding ahead of time how to fund long-term care expenses can help families absorb the cost without depleting other financial resources.

What is Long-Term Care?

Long-term care means ongoing assistance a person needs to help with activities of daily living and medical care. The assistance can range from in-home care to community-based care to a live-in facility for those needing the highest levels of care.

Appropriate options for long-term care in Florida depend on the anticipated levels of care, which can progress over time. As a greater level of care is needed, the cost of care increases.

- Home healthcare – In-home care can be medical or non-medical. It is designed to encourage independence for as long as possible.

- Personal care homes – Residential care communities provide services similar to home healthcare agencies.

- Assisted living facilities – Apartment-like living with communal areas for dining and activities. Many activities of daily living are provided by the facility. Healthcare services are provided or arranged.

- Skilled nursing facilities – These live-in homes provide the highest level of care for persons least able to care for themselves. They can accommodate residents with serious medical needs.

Why Long-Term Care Planning is Important

Why Long-Term Care Planning is Important

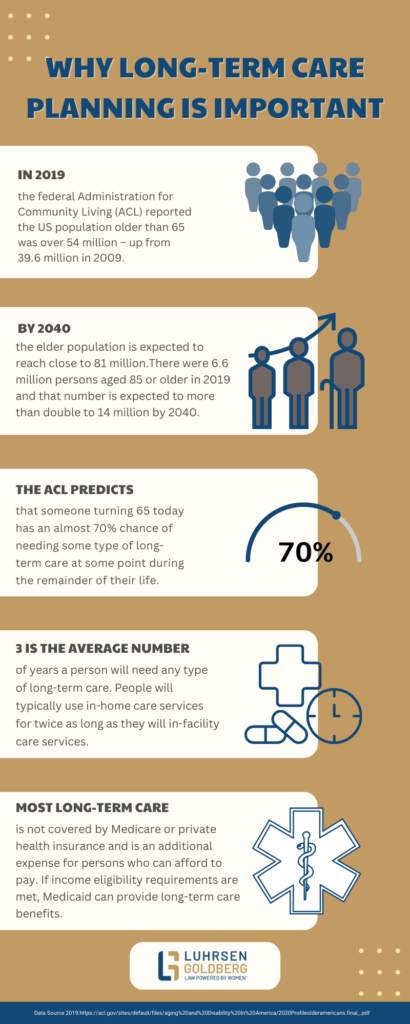

People are living longer, and as they live longer, they need more help with living. In 2019, the federal Administration for Community Living (ACL) reported the US population older than 65 was over 54 million – up from 39.6 million in 2009. By 2040, the elder population is expected to reach close to 81 million. There were 6.6 million persons aged 85 or older in 2019 and that number is expected to more than double to 14 million by 2040.

The ACL predicts that someone turning 65 today has an almost 70% chance of needing some type of long-term care at some point during the remainder of their life. Three is the average number of years a person will need any type of long-term care. People will typically use in-home care services for twice as long as they will in-facility care services.

Most long-term care is not covered by Medicare or private health insurance and is an additional expense for persons who can afford to pay. If income eligibility requirements are met, Medicaid can provide long-term care benefits.

Factors Affecting the Need for Long-Term Care

A person’s age is most commonly associated with the need for long-term care, but other personal circumstances will also factor into determining when care may become necessary. The following factors are relevant to the need for long-term care:

- Age – The longer the person lives, the more likely care will be needed.

- Gender – Women generally outlive men and are more likely to end up living alone in the home.

- Disability – The possibility of disability increases with age, but accidents and chronic illness can result in disability at any age.

- Health – The prognosis for certain health conditions could indicate long-term care may be necessary in the future. Poor lifestyle choices can also precipitate the need for long-term care.

- Living alone – People living alone do not benefit from the help of others in the household.

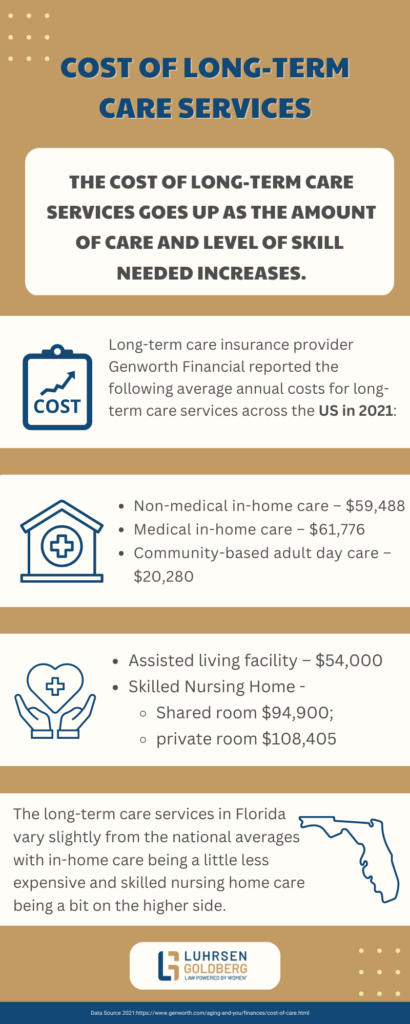

The Cost of Long-Term Care Services

- Non-medical in-home care – $59,488

- Medical in-home care – $61,776

- Community-based adult day care – $20,280

- Assisted living facility – $54,000

- Skilled Nursing Home – Shared room $94,900; private room $108,405

The long-term care services in Florida vary slightly from the national averages with in-home care being a little less expensive and skilled nursing home care being a bit on the higher side.

Who Pays for Long-Term Care?

Long-term care will need to be privately funded unless a person qualifies for a government benefit. A Long Term Care Insurance Policy may also pay for Long Term Care, but newer LTC policies have significant exclusions and may not pay the entire amount. Federal and state programs offer long-term care benefits to qualifying persons.

- Veterans Administration – The VA offers long-term care benefits to qualifying Veterans.

- Medicaid – Medicaid is eligibility-based healthcare for low-income persons and is administered by each state according to federal regulations. Medicaid coverage includes long-term care benefits.

Medicare and some private health insurers will provide coverage for nursing-type care either in a facility or at home for a short period – typically a number of days. But assistance unrelated to healthcare is not covered.

Funding Options When Planning for Long-Term Care

Planning for long-term care may mean setting aside funds specifically earmarked to cover long-term care expenses, or it can mean doing what is necessary to qualify for government-sourced benefits. Personal circumstances and planning goals will determine the appropriate strategy.

Qualifying for Medicaid

There may be situations where it is beneficial for someone needing long-term care to actually plan to possess only the minimum amount of assets that are allowed in order to qualify to receive Medicaid benefits. This can involve giving up legal ownership of property in excess of the minimum amounts either by giving it away or by transferring it to a special type of trust.

A properly created trust can own property that benefits a person receiving Medicaid without jeopardizing their eligibility so long as the trust property is used only for specific purposes. However, property ownership transfers must not occur within 5 years of applying for Medicaid or the value of the property transferred will count against eligibility for a calculated period of time.

Long-Term Care Insurance

Long-term care insurance is a separate insurance policy underwritten specifically to provide long-term care services when qualifying circumstances are met. Persons who want to obtain long-term care insurance must apply and be accepted by an insurance company.

Long-term care policies generally will not be issued to persons who are already in need of care or who have conditions making it more likely long-term care will be necessary. The cost of a long-term care policy will increase with the age of the applicant, regardless of health. Policies will typically have a stated maximum limit they will pay or a designated length of time that benefits will be provided.

Life Insurance

Certain life insurance policies may provide both a death benefit and a long-term care benefit. The long-term care benefit may be expressed as a percentage of the death benefit.

Some life insurance policies allow the policy owner to receive an ‘advance’ on the death benefit for certain long-term care services. An Accelerated Death Benefit (ADB) is paid tax-free to the policy owner and reduces the benefit amount payable upon death. The ADB can be less than the full policy limits, and the monthly payments may be a limited amount.

Florida Medicaid Programs and Long-Term Care

Florida has several Medicaid programs that can assist with the costs of long-term care. Qualification is based on eligibility criteria, income levels, and needs. But people do not have to be destitute to qualify for Medicaid benefits. With proper planning, a person can qualify for Medicaid and maximize the retention and use of personal finances.

The Statewide Medicaid Managed Care (SMMC) Long Term Care Program provides the following long-term care benefits:

Institutional Care Program (ICP)

ICP is for persons who require skilled nursing care from a live-in facility. Every person who meets the requirements for this benefit must be placed. There is no waiting list for this level of care. Recipients must pay all of their income except a small allowance toward their care, and Medicaid pays the balance.

Married persons can qualify for Medicaid separately. If one partner needs ICP care, but the other can remain in the home, the equity in the home and the income of the non-ICP spouse do not count against the Medicaid recipient. Some of the Medicaid recipient’s income may also be diverted to the spouse remaining in the home.

Medicaid Waiver/Home & Community-Based Services

This program is for persons who can live in assisted living facilities (ALF) or at home with in-home care. It provides financial assistance to pay for services, and recipients can keep their income. However, there is a waiting list to receive benefits.

The waitlist is prioritized by need. A recipient’s need is determined by the evaluation of an application. Careful completion of the application can help improve an applicant’s priority position on the waitlist. This is significant because the waitlist in Florida is long. An applicant can wait 7 or more years before receiving services.

Once authorized, these Medicaid benefits can also help recipients keep more of their money by paying some of the costs not covered by Medicare.

Qualified Medicare Beneficiary (QMB)

QMB benefits help with the cost of prescriptions, co-payments for medical services, and Medicare premiums. These expenses are also covered by the Medicaid Waiver program but there is no waiting list.

Persons who may be on the Medicaid Waiver waitlist can receive QMB benefits during the waiting period to help offset long-term care costs.

Medicaid Long-Term Care Eligibility

Medicaid Long-Term Care Eligibility

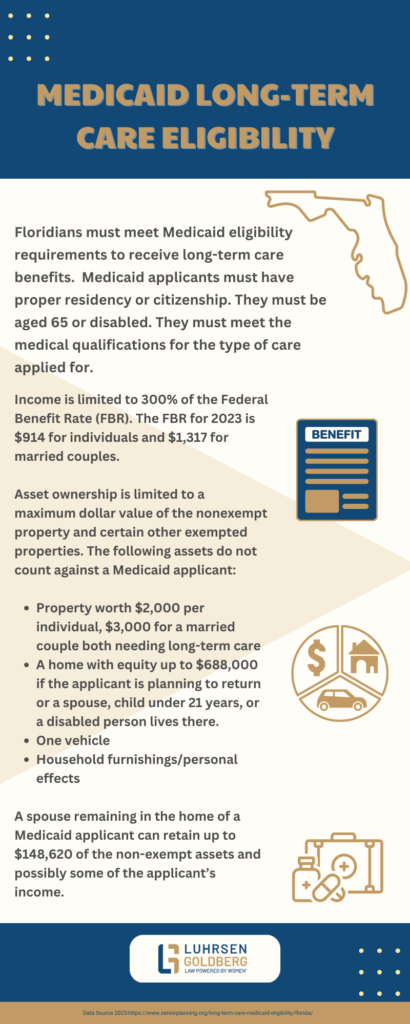

Floridians must meet Medicaid eligibility requirements to receive long-term care benefits.

Medicaid applicants must have proper residency or citizenship. They must be aged 65 or disabled. They must meet the medical qualifications for the type of care applied for.

Income is limited to 300% of the Federal Benefit Rate (FBR). The FBR for 2023 is $914 for individuals and $1,317 for married couples.

Asset ownership is limited to a maximum dollar value of the nonexempt property and certain other exempted properties. In 2023, the following assets do not count against a Medicaid applicant:

- Property worth $2,000 per individual, $3,000 for a married couple both needing long-term care.

- A home with equity up to $688,000 if the applicant is planning to return or a spouse, child under 21 years, or a disabled person lives there.

- One vehicle

- Household furnishings/personal effects

A spouse remaining in the home of a Medicaid applicant can retain up to approximately $148,620 of the non-exempt assets and possibly some of the applicant’s income.

The Right Time to Start Long-Term Care Planning

Some type of long-term care is likely to be needed by the majority of people as they age. So planning for the eventuality could benefit the majority of people. But it’s not being done nearly as often as it should be, and the burden of long-term care is increasingly depleting family resources.

Elder advocate AARP says there needs to be more awareness about the need for long-term care, what it costs, and how to financially prepare for it. Starting the planning process at an earlier age can help prepare for the possibility of significant additional care costs without creating a financial burden on family members.

Discuss Your Long-Term Care Planning Needs with a Florida Elder Law Attorney

Planning for long-term care expenses is the practical way to address a very real risk to your family’s financial security. With sound planning, families can provide for their eventual needs while maximizing the ability to preserve personal wealth.

Luhrsen Goldberg’s team serves Sarasota, Bradenton, Lakewood Ranch and surrounding areas and is ready to guide you to providing the long-term care planning you and/or your loved ones may need. To learn how we may be able to assist or to request a free case evaluation, please contact us today.

Why Long-Term Care Planning is Important

Why Long-Term Care Planning is Important Medicaid Long-Term Care Eligibility

Medicaid Long-Term Care Eligibility